Caution: not investment advice.

Remember FAANG Stocks? (Facebook Apple Amazon Netflix Google) These big winner-take-all companies dominated the past two decades in technology, from a mindshare and market valuation perspective.

As global decarbonization accelerates, more and more clean energy companies worth billions are appearing on the scene. But who will be the big FAANG-like winners of decarbonization, if any?

Here’s three American companies on a plausible path to get there, each with different models.

I’ve picked these because they’re worth watching: they’re already very successful, and operating at massive scale. No idea if they’re good investments. From smallest to biggest:

Enphase

Enphase, originally a Silicon Valley based startup, isn’t quite worth $100B yet, but it’s not far off. They’ve become mega-valuable due to their fast growth, microchip-type margins, and proprietary technology at the heart of accelerating global adoption of rooftop solar.

Originally a commodity component of other companies’ rooftop solar offerings, Enphase’s micro-inverters and software have turned into the brains of those installations. Plus, the company offers a product portfolio of the other stuff you need to make residential decarbonization powerful and cost effective (battery storage, car chargers, off-grid capability, etc).

Here’s Enphase’s company overview slide, from a recent investor presentation (you can tell it’s a company run by engineers):

Enphase sells billions of dollars of solar micro-inverters a year – devices that convert DC power from solar panels to usable AC power for the home. And their growth is accelerating as the rising cost of grid electricity globally makes generating your own rooftop power a no-brainer.

Enphase sells its products through a long tail of tens of thousands of solar installers, and plans to use that channel to distribute the more comprehensive home solar, storage and changing product portfolio it’s developing (basically everything but the panels themselves):

The market’s given Enphase a premium valuation due to its sales growth, microprocessor-type margins, and the potential to have a more dominant product position in a fast-growing global market.

With a lot of competition (like Tesla) also gunning to own this residential power ecosystem, Enphase will have to execute pretty well to keep winning. Who knows if they can, but they’re worth watching, because few other companies have this combination of proprietary technology, scale, manufacturing capacity and potential to own and control the energy operating system for buildings around the world.

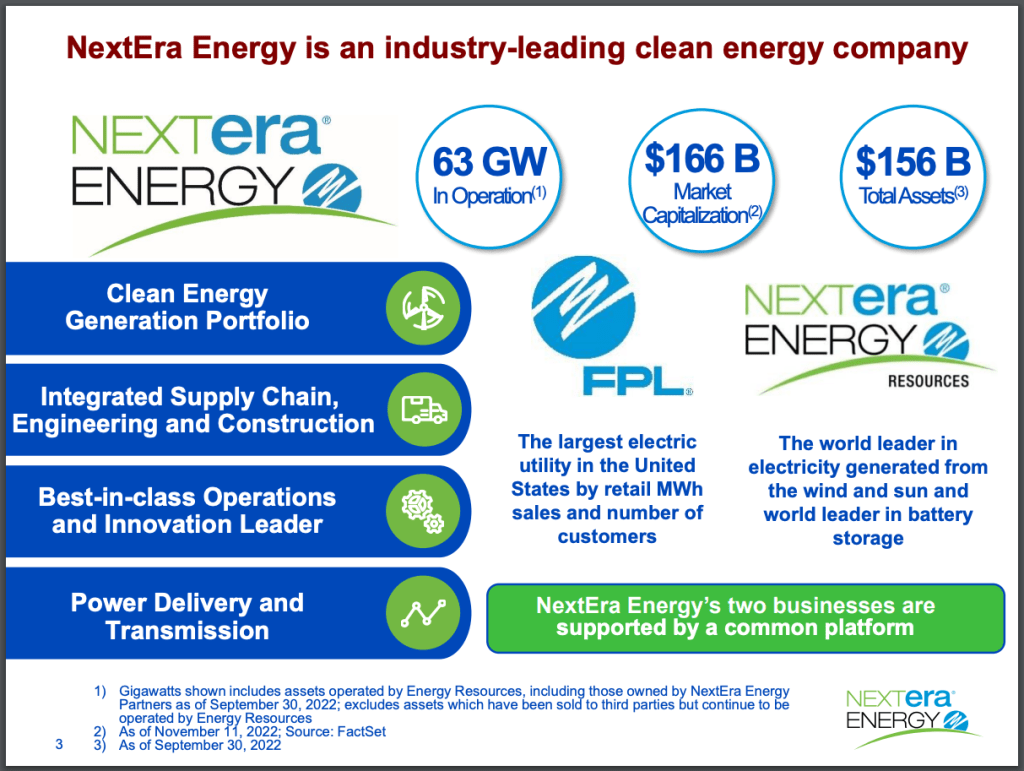

Next Era Energy

This Florida-based company is one of the largest developers and operators of clean energy projects (wind, solar, storage, green hydrogen) in the world. While not 100% a clean energy company (they own a legacy electric utility, Florida Power and Light), I’ve included them because their huge market cap is mostly due to their clean-energy growth business.

Next Era Energy isn’t a technology company, they just got into the renewables game early, and with conviction – becoming the largest producer of wind and solar power in the U.S. in 2009. They’ve kept building more and more, resulting in increasing know-how, scale cost advantages, and financing capability and leverage.

Here’s the money chart – from a recent Next Era investor presentation – that shows why renewables are winning worldwide and in the U.S., both on the regulated grid and for direct sale to corporate, commercial and industrial customers.

Renewables are just a better business than fossil fuels, because you don’t have to buy the fuel and schlep it all over the world to generate power. Unless you’re a regulated utility like NextEra’s subsidiary Florida Power and Light, and can keep forcing ratepayers to pay you for dirty coal and gas plants you built decades ago.

(This is one big downside of NextEra from a climate perspective… a lot of their profits still derive from Florida Power and Light, which seems in no hurry to decarbonize or shut down it’s coal plants in politically conservative Florida).

NextEra’s plan is to disrupt the slow-changing fossil fueled power market in the U.S. with renewables – which presumably they can do smarter because they also own a fossil fueled utility? One part of this is displacing fossil fuel for residential utility customers. The other (faster, less regulated) is selling directly power directly to commercial customers who are eager to lower costs and decarbonize faster.

Will Next Era have winner-take-all economics? Will they be able to increase their market share, dominance and profitability in an increasingly competitive U.S. (and global) decarbonization market?

I have no idea, but they’re worth watching, because they already have such massive scale and are as close to a decarbonization pure-play as any legacy company.

Tesla

Tesla doesn’t need another write-up, but as the most valuable clean energy company in the world, I’d be remiss to not include it here.

Tesla is the only non-Chinese company that’s leading on electrifying transportation, and already producing millions of EVs per year. Plus it’s got a sizable side business helping decarbonize the global electric grid, with its massive utility scale and microgrid battery installations.

These two hyper-competitive markets have tons of players, but Tesla’s brought lots of innovation so far: from business models to advanced materials to powertrains and vehicle and battery design. Not to mention scale – the company has gone from one factory to half a dozen in just a few years (and over 100,000 employees).

It’s hard to find Tesla presentation slides that aren’t pictures of cars or factories, but here’s a couple that tell the money story of why Tesla’s products are selling (aside from the fact that Tesla made electric cars sexy with great design and race car driver specs).

In short, Tesla’s decarbonization products make economic sense, whether you look at total cost of ownership for the cars, or grid economics for the energy business:

The numbers are there – if buyers do run the numbers – to support massive decarbonization of the transportation and energy sectors now.

Tesla’s helped overcome the awareness and go-to-market barriers to this adoption with its aggressive brand building and direct distribution model. And because it’s been able to scale manufacturing and revenue, Tesla has become the world’s leading (and most highly valued by the market) decarbonization company.

Can it maintain that status and grow even further, or will it implode due to its seeming dependence on one individual? Who knows, but the world is watching.